Nonprofit Impact Report, Issue 1: Coronavirus, Oil Prices, & Stock Market Volatility

A Trifecta of Challenges

Just a month ago we could not have anticipated that three major events would develop as rapidly as they have, and nonprofits are among the many types of businesses trying to determine what the impact will be on their operations and funding.

While the situation is changing rapidly, this snapshot report summarizes what we know at this time, what we do not know yet, and what experience tell us about how to move forward in light of:

- The rapid spread of the coronavirus and the impact of this spread on society and the economy;

- The drop in oil prices, which has an outsized impact on Houston and its economy; and

- The volatility of the stock market.

We have the benefit of past disasters and downturns to guide us. 9/11, the Enron crisis, Tropical Storm Allison, the recession of 2008–2009, Hurricane Harvey, and declines and volatility in the price of oil all created significant turmoil in Houston’s nonprofit sector in the past. The experience we have gained while riding out these events offers a silver lining.

Sterling’s main message is that nonprofits endure and donors continue to support them through even the worst of times. We know how to mitigate the impact of catastrophic events and now have the opportunity to analyze what is happening, make adjustments to maximize our viability, and remain flexible as we see how the drop in oil prices and the stock market affect the nonprofit world. Do not overreact!

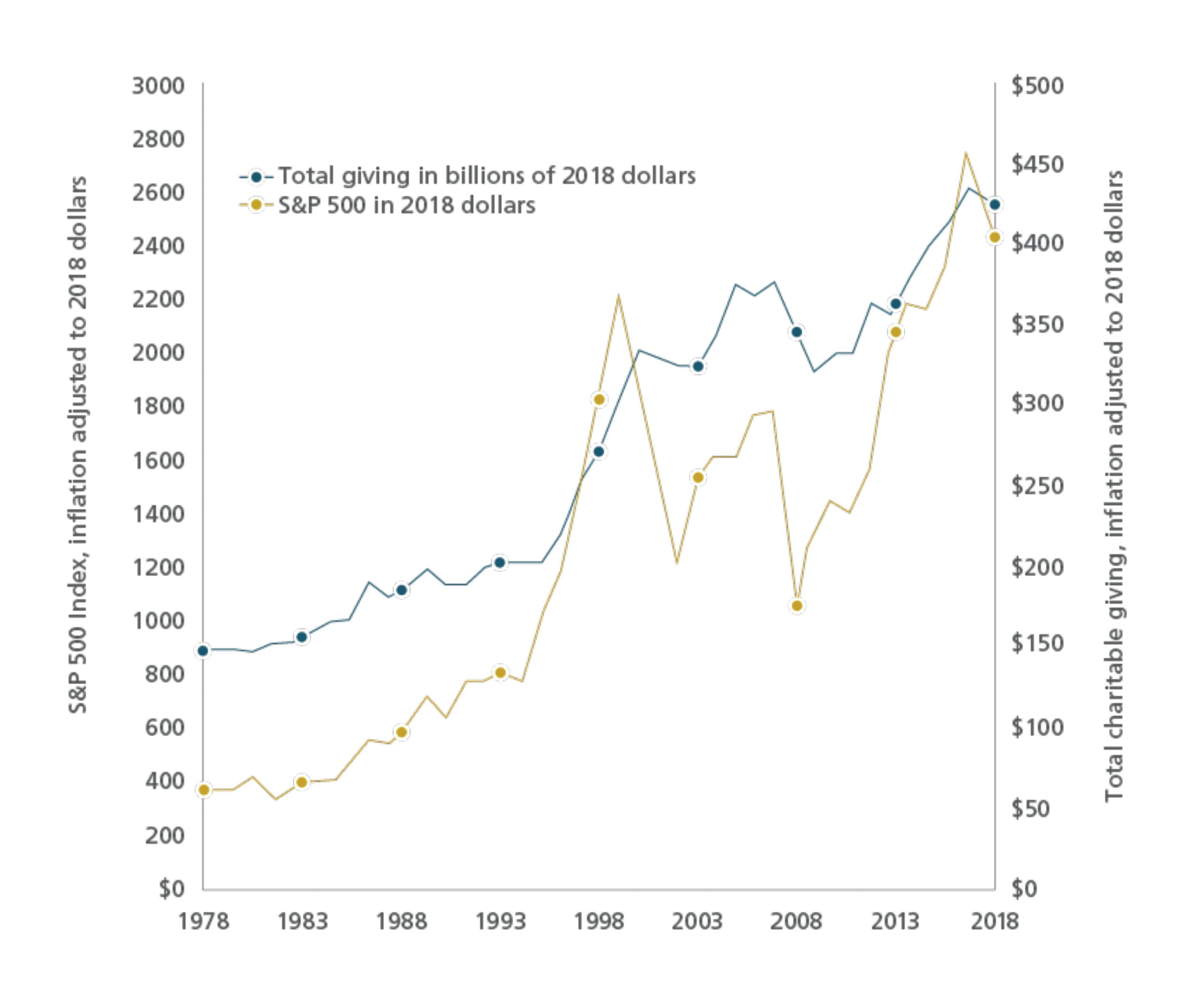

Total charitable giving graphed with the Standard & Poor’s 500 Index, 1978–2018 (in billions of inflation-adjusted dollars)

Source: Giving USA

Source: Giving USA

The Issues Summarized

- The coronavirus is spreading rapidly around the world and across the United States, creating shockwaves as people reduce travel and activities that bring them together. In Houston, that response has been moderated to a degree: the Rodeo goes on, for example (because more than 90% of those attending are from Texas), while the CERA Conference has been cancelled (because delegates attend from more than 80 countries).

- As people and businesses cancel travel plans and big public events are called off, people are traveling less. This has had an impact on the demand for fuel, leading to softening in oil prices, but that impact has been greatly exacerbated by the fact that Russia and OPEC have not reached an agreement on production. As OPEC nations increase their production, they are causing a precipitous drop in prices. Nobody needs Sterling to explain the impact this has on Houston-based companies up and down the supply chain.

- Due to the uncertainty surrounding the future impact of the coronavirus on the consumption of goods and services, coupled with the oil price shock, the stock market has been extremely volatile.

- Charitable giving is affected more by the performance of the stock market than any other factor, but giving has never fallen as dramatically as the market does.

Impact on the Nonprofit Sector

In each of the past crises, nonprofits have been affected in a variety of ways. As we look at the current situation, we can expect that:

- The demand for nonprofit services is likely to increase. When the economy suffers, people suffer—and they turn to nonprofits for help. If employment is affected by the changes in our economy, we can expect that the demand will increase on nonprofits providing housing, food assistance, basic living needs, health care, mental health support, and other areas of need.

- Charitable giving is likely to be affected, but the change will not be the same for all nonprofits. In the past, we have seen that many individuals deviate from their usual giving habits when they see that real people need real help. They often divert some dollars from certain groups (the arts are often the ones that lose a bit of giving share) to give more to others that meet basic needs. Then when the economy improves, they reallocate again.

- Foundation giving will be somewhat protected as long as we do not enter into a prolonged bear market. Many Houston foundations stopped making multi-year commitments after 2008–09, and this provides them with some protection if their corpuses decline because they won’t be left making pledge payments in future years against smaller returns. Also, many have spending policies that require them to make gifts out of earnings on a 36-month rolling average, so they’ll be protected in some measure because the earnings of the past two years have been so strong. The same is true for high net worth individuals making gifts from their asset base or from donor-advised funds.

- Corporate giving will be affected. Houston’s corporate community is generous, but any business’s first responsibility is to its shareholders. If our biggest employers are seeing reduced profits, they will cut back on their giving. Since corporations provide only 5% of all the charitable giving in the average year, this will not affect all nonprofits but will have an outsized impact on those depending disproportionately on corporate giving.

- Nonprofits will benefit from all the work they have done tending to the basics during the proverbial good times: stewarding their donors attentively and personally, building cash reserves to cover at least six months of their annual budgets, and ensuring the excellence of their core programs and services.

Recommendations and Advice

To ensure the ongoing strength of your organization, create an ad hoc team to consider the impact of the current environment on your operations and create a working framework for the next 3–6 months.

Questions to ask:

- What impact will the economy have on your organization, both programmatically and financially?

- How can you adjust your plans to mitigate the impact?

- If your mission allows it, how can you respond directly and communicate with donors and others about how you are important to the community in ways that may or may not be obvious? How can you tailor your story in different media to show that you are carrying on the important work you do?

- What are your contingency fundraising plans to get through the bumps that always occur when donors respond to immediate needs? If your organization is dedicated to meeting those needs, define your story and start putting it out into the world. If your organization does not meet those needs, develop a story that shows why you still deserve support.

If you are in the midst of a capital campaign, do not stop. It is the kiss of death to put a campaign on hiatus, and charitable giving will not fall through the floor. You might have to work harder for those gifts, and it might take longer to finish, but persist.

If you are planning a capital campaign, develop or adjust your plan with an eye to the rapidly changing environment. The Wortham Center capital campaign was famously finished during the worst oil bust in Houston’s history, as was the Houston Food Bank’s campaign a decade ago—and the leaders of those campaigns never thought of quitting. Sterling saw campaigns that launched in 2008 and 2009 finish successfully, and we will see the same this year and next. At the same time, many foundations and individuals reduced their giving to capital campaigns in 2008 and 2009, so it will be important to keep an eye on the stock market to see whether campaigns will be affected in 2020 and 2021. We hope the market will stabilize, and in the meantime, you will want to be clear-eyed about your prospects, focus on the essentials, and risk-adjust conservatively—without setting yourself back five years by reacting too fearfully.

Stick with the basics of good annual fundraising to weather the storm. The process of retaining your existing donors and building support from those who are most loyal must continue. If you do not take care of those relationships, others will be waiting to take their attention and you may not get it back.

It takes a bit of faith to lead any nonprofit organization. Keep that faith and summon your intelligent optimism, combined with good planning, to carry on.